Have you ever asked yourself, how to avoid capital gains tax on property in Canada? Suppose you’ve been researching capital gains tax or how to avoid it in Canada. There are strategies you can use. Keep reading.

Table of Contents

What is a Capital Gains Tax?

When you sell a capital asset, such as any depreciable property you bought as an investment or to generate income, you have to pay capital gains tax. It’s critical to manage the capital gains tax since, at the end of the year, your income tax amount is increased by 50% of the proceeds from the sale of your investment.

“A capital gain is the amount of money you make while selling assets or capital property.”

For instance, your capital gain would be the $80,000 difference between the purchase and selling prices if you were to purchase a rare gold ring for $20,000 and then sell it for $100,000. That would require you to disclose it on your income tax return.

The amount of money you must pay on the profit from this kind of transaction is known as the capital gains tax, and it is included in your income taxes since capital gains are regarded as a sort of taxable income. Many people who receive family property as inheritances eventually sell it because they already own a house or do not want to maintain it.

Even though it appears simple enough, figuring out this figure isn’t always simple.

Have you ever thought about how to avoid capital gains tax on inherited property in Canada? The typical method of calculating capital gains is to deduct the sale price from the fair market value at the time of acquisition. However, you might not be aware of the purchase price when selling an inherited property, as the value is frequently determined when you assume ownership of it.

Therefore, even if there isn’t an inheritance tax in Canada, you still need to be aware of a few things to ensure that you file and pay any taxes due at the rates applicable to your income.

How to Avoid Capital Gains Tax on Inherited Property in Canada?

Unlocking the secret behind, how to avoid capital gains tax on inherited property in Canada!

If you live on inherited property as your principal residence, you can generally avoid paying capital gains tax on that property in Canada. You or the estate won’t be required to pay capital gains tax when you take ownership of the house if it was the person who passed it on to you as their principal residence. The exemption for a primary dwelling is to blame for this. On the other hand, 50% of the gain on the sale of that property will be subject to capital gains tax.

Does Inherited Property Require Tax Payment?

No taxes must be paid immediately when inheriting a house unless it was the deceased’s secondary (rather than principal) residence. The Canada Revenue Agency treats the property as though it were sold by the deceased, and any capital gains taxes due on it for the transfer are included in the final income tax rates of the deceased. A clearance certificate is needed to verify that the deceased person’s estate has paid all due taxes.

Let’s Find Out How to Avoid Capital Gains Tax on Property in Canada?

Place Your Income in a Tax Haven

Tax shelters protect your investments by acting as umbrellas. Your investments can grow duty-free if they stay inside a tax shelter. Stock purchases and sales are tax-free and can be done whenever you choose.

One of Canada’s most widely used tax havens is an RRSP, also known as a Registered Retirement Savings Plan. Any earnings you make within an RRSP-registered account are not subject to taxation at the time of earning. Since you did not pay taxes on your income when you contributed, you will be taxed at your full marginal rate when you withdraw money.

Balance Out Capital Losses

Talk about victories and defeats. If you sell ABC stock for $1,000 in the same year and lose $1,000 when you sell XYZ stock, your profit is essentially zero because the gains and losses cancel each other out. You won’t be subject to capital gains tax in that case.

However, what if you have losses to report, and this wasn’t your year? You can apply your losses to subsequent years by carrying them forward or backwards in that scenario. You can carry them forward indefinitely and accrue them or carry them backwards for up to three years to negate any gains for a tax refund. In certain cases, you may even be able to deduct your capital losses or totally avoid the taxes from other types of income in some situations. Still, you should speak with a licensed accountant about this tactic.

Utilize the Exemption & Avoid for Lifetime the Capital Gains

Certain small business owners may be eligible for the lifetime capital gains tax exemption when they sell qualifying private shares and farm and fishing property. Qualifying shares are those held by Canadian owners of a business in Canada. Furthermore, the shares had to be owned by the taxpayer or a family member for a minimum of 24 months before the sale. The lifetime exemption is $1,016,836 in 2023. Because of the complexity of the requirements, speak with an experienced tax expert. For stocks, you cannot avoid the capital gains taxes for a lifetime..

Give Your Shares to a Worthy Cause

Do you need extra motivation to conduct good deeds? You can think about donating your shares to a charity instead of cash. It’s a cost-effective method to gain goodwill. In addition to the shares’ “profit” being deemed to be zero, you also receive a donation tax credit determined on the shares’ market value at the time. That way, you can avoid paying capital gain taxes. What a win-win situation.

Final Word

In Canada, handling and avoiding the capital gains tax on inherited property can be exceedingly difficult, particularly if you are unaware of the nuances of tax legislation. Fortunately, there aren’t many exceptions that you have to be aware of, and the majority of what you require to understand these rules is included in this tutorial.

So, how to avoid capital gains tax on property in Canada is now unlocked! We are pleased to offer broad insights into these subjects here. Speak with an accountant to help you with the transfer and documents so you can take care of your situation and obtain the most recent information!

An expert property management business can support you in efficiently managing the property and giving you the answer of how to avoid capital gains tax on inherited property in Canada. Speak with us today & find out how you can avoid paying capital gains tax on your properties!

Related Articles

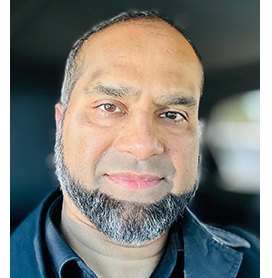

My name is Adnan Khan and I am a realtor specializing in Pre-construction condos and homes sales.

I also do assignments of condos. You can contact me at 416-897-4714

Designation: P.Eng

Education: McMaster University, Engineering Technology

Specialty: Residential Real Estate

Experience: 15+

Area Covered: Downtown Toronto and Neighboring Area

Languages Spoken: English, Urdu

Leave a Reply