With average home prices expected to rise by 17.1% in 2020, the Condo Rental Market Growth Analysis market is now strong because of cheap mortgage rates, increasing demand brought on by the pandemic, and a limited supply of property.

But a market cooling is anticipated by 2024 as a result of higher interest rates, more stringent mortgage regulations, and more housing supply. It is anticipated that the Condo Rental Market Growth would rebound significantly, offering investors chances. With the possibility of a “housing crash” because of high real estate prices and uncertain economic conditions, the Ontario housing market is expected to continue expanding.

While Vancouver’s market is anticipated to slow down, Montreal’s is forecast to flourish. Despite these obstacles, it is anticipated that new condos in Oshawa’s real estate market will continue to be robust. Although continuous growth is anticipated also in the Linked properties, a dramatic decline in real estate prices is unlikely.

Table of Contents

Condo Rental Market Growth Analysis

For real estate investors, the new year means fresh questions. What does the Condo Rental Market Growth Analysis have in store for the upcoming year?

Tenants are looking forward to relief from skyrocketing rents as issues with affordability continue to escalate. Conversely, investors expect that a decline in mortgage rates will make it easier to purchase additional rental properties and sources of income.

It doesn’t take a keen eye to see that the Condo Rental Market Forecast has been erratic in recent years. From late 2020 to early 2022, Condo Rental Market Forecast about interest rates experienced significant price increases. Part of the reason for this was that the market was already undersupplied. This undersupply was only made worse by COVID-19 delays.

In 2021, rents increased significantly as well, rising by up to 16% annually. Rent rises have surpassed inflation and contributed to what is currently recognized as a significant affordability concern, despite being fantastic for real estate investors. Home ownership is out of reach for many due to a combination of factors including competitive markets, insufficient supply, high mortgage rates, and high prices for properties that are for sale. When 2024 approaches, will these patterns hold true?

Reflecting on where we’ve been in the condo rental market competitive analysis journey reveals a path of discovery and strategic evolution. We’ve embarked on a meticulous exploration of the market landscape, meticulously dissecting the tactics and offerings of our competitors. Through exhaustive research and data analysis, we’ve uncovered valuable insights into pricing structures, amenities, and customer preferences.

Each step of this journey has been instrumental in shaping our understanding of the market dynamics and identifying opportunities for growth. Moreover, this retrospective allows us to appreciate the progress we’ve made and the milestones we’ve achieved in positioning ourselves competitively. As we continue forward, armed with the knowledge gleaned from our past endeavors, we’re poised to navigate the ever-changing currents of the condo rental market with confidence and agility.

Our Destination

According to experts, several trends are expected to persist on their current paths. In 2024, renters will still be renting despite high costs since buying a home is still more expensive than renting because mortgage rates are still high. However, Zumper believes that rent will continue to decline for at least the first half of 2024, particularly in Sun Belt areas like Austin and Phoenix, so things aren’t looking too bad for them thus far.

Additionally, with new multifamily inventory arriving this year to alleviate the undersupply in the rental market, tenants will finally profit from resumed building. An increase in housing supply will encourage landlords to maintain fair rents because tenants will have more options for better condo rental market forecast.

Increased housing availability will encourage landlords to maintain fair rents because tenants will have more places to live. Even though significant multifamily buildings are being finished, construction finance is predicted to decline in 2024, so it’s possible that the effects of new construction will change in 2025 and after.

In 2024, inflation is also declining. Rent prices will rise in response to an increase in housing demand if it keeps declining. Nevertheless, experts that write for Bigger Pockets advise against expecting a significant, widespread rent increase in 2024 in new condos in Oshawa’. The costs of federal student loans, inflation, and overall economic uncertainty are already a burden for American renters. The rent is already very expensive. Rent prices may rise in some cities (such as smaller cities outside of the Sun Belt).

However, it is anticipated that median rent prices will remain steady this year, thus in that terms Condo Rental Market Forecast significant increases in rent will have to wait until 2025.

But rent pressure may still be mounting. Among other worries, rising interest rates, inflation, and abnormally high oil prices have caused Americans to continue fearing a domestic and worldwide recession. However, more people may choose to rent independently in the upcoming year rather than saving for a down payment if the economy is steady. The rental market is influenced by a wide range of factors, some of which are covered in detail in the section that follows.

Condo Rental Market Forecast in Canada by 2024

According to analysts’ predictions for the Condo Rental Market Forecast 2024, the housing market would cool off. This is probably caused by a number of things, such as the rising house supply, stricter mortgage lending regulations, and the predicted increase in interest rates. This trend may also be influenced by the return to the office, as there may be less demand for suburban and rural real estate.

Conversely, it is anticipated that by 2024, the rental market would grow significantly. The rental market is anticipated to rebound following a downturn during the pandemic, propelled by immigration and returning foreign students. Furthermore, the Condo Rental Market Growth is anticipated to remain strong due to the demand for reasonably priced housing options in urban regions.

By 2024, it is anticipated that the housing market would also be more balanced. It is anticipated that the dynamics of supply and demand would balance out, creating a robust and long-lasting real estate market. As a result, the bidding wars that were typical in the market would disappear.

Lessons from the Rental Housing Market

Experts agree that the rental market will continue to deteriorate. Even when prices approach the edge of affordability, Americans will continue to be cautious and hold out hope for improved economic conditions and cheaper rents as supply grows. Investors need not worry—rent prices will either barely decrease or remain unchanged, and growth may even accelerate in several smaller markets. As always, geography will be crucial because regional patterns may diverge significantly from broad national stereotypes.

Landlords need to be able to adjust things like rent prices and lease terms depending on what’s happening in the market. Similarly, tenants need to be prepared to handle changes in their financial situation or their housing needs. Another lesson is all about communication. It’s super important for landlords and tenants to talk openly and honestly with each other. Landlords need to keep tenants in the loop about things like repairs and changes to the property, while tenants need to let landlords know if there are any problems or concerns.

Research is also key. Landlords should keep an eye on what other rental properties are going for in the area, while tenants should do their homework to find a place that fits their budget and lifestyle. In the end, both landlords and tenants benefit from being adaptable, communicating well, and staying informed about the rental market.

In Summary

Predicting the future with any degree of accuracy is never guaranteed in the dynamic rental housing market. Although we’ve looked at a number of possible trends, unexpected circumstances can still arise in real estate due to its dynamic nature.

Despite the fact that uncertainty will always exist, Even while there will always be some degree of uncertainty, we’ll keep an eye on things and give you frequent updates so you can face the upcoming year with confidence in Condo Rental Market Growth.

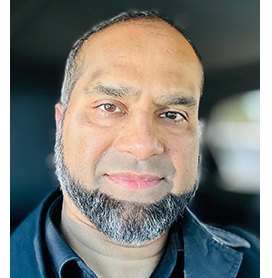

My name is Adnan Khan and I am a realtor specializing in Pre-construction condos and homes sales.

I also do assignments of condos. You can contact me at 416-897-4714

Designation: P.Eng

Education: McMaster University, Engineering Technology

Specialty: Residential Real Estate

Experience: 15+

Area Covered: Downtown Toronto and Neighboring Area

Languages Spoken: English, Urdu

Leave a Reply