We understand how much you despise taxes in general, but they are necessary for real estate ownership. Staying informed whether there is property tax on condos, might help you better handle your property taxes. However, the details vary depending on where you live and your property type.

In this comprehensive blog, we will examine the variables that drive the property tax rate for condos, common misconceptions about these taxes, and how they affect condo owners.

So, let’s go into all you need to know about condo property taxes.

But Before That, Let’s Take a Moment to Know What is a Condo?

Condos are a form of housing development that caters to purchasers and renters.

Table of Contents

What Does an Owner of a Condo Shall Expect for Its Taxation?

When purchasing a condo, consider the future. Take your time with the sales and purchase your unit without preparing. You should be conscious of all the specifics around the transaction and how it will be handled. Examine all relevant documents thoroughly and ensure that you understand every aspect.

Condo fees cover a wide range of living expenditures. Repairs, landscaping, emergencies, and building repairs are typically included in the condo fees. However, the land tax is not included. As a result, you will be responsible for paying property taxes for the condos.

The property tax on condos varies greatly based on the region and other variables. It can change throughout the Greater Toronto Area. In the paragraph below, we will learn about the computation.

What a Condo Owner Must Know

As a condo owner, you ought to know how property taxes in Canada operate and how they affect your budget. The government assesses taxes on condominium properties based on the value of each unit. These taxes support municipal services and infrastructure. Assessors establish property tax rates for condominiums by determining the market value of every apartment and applying a certain percentage or mill rate.

State and State Agencies

use the condo property tax to fund important services in your community. These services include rubbish pickup, the preservation of open public utility places, and safeguarding against fire and sanitation. The tax rate you must pay varies depending on the neighborhood where you buy the house.

To get the total annual payment, multiply the current tax rate by the cost of the property. The amount payable to the government reduces as property values rise while total tax rates in the area fall.

Property Tax on Condo Arrives After Conclusion of Multiple Factors

Several factors can influence the property tax rate on a condo. Therefore, it is critical to recognize these elements when purchasing or selling. Some of the main elements impacting property taxes are:

1. Location of The Condominium

Property tax rates on condos vary based on the location. Tax laws and regulations can significantly impact the amount of tax owed. For example, some regions may raise their tax rates to cover the extra expenditures of delivering more public services.

2. Value and Pricing of The Condo

The assessed value of your condominium unit is a crucial factor in setting your property taxes. Generally, higher-valued properties will pay more in taxes than lower-valued ones.

This property appraisal considers characteristics such as square footage, age, condition, and recent sales prices of comparable regional units.

3. Influence of The Local Laws & Taxes

Every region has its own set of rules regarding property taxes. These can include exemptions for specific categories of homeowners (e.g., seniors or veterans), limits on annual increases in assessed values, and millage rates (the amount per $1,000 used for determining taxes).

For example;

Individual tax rates for each Canadian city are determined at the provincial level. In Toronto, the lowest current tax rate is approximately 0.61%. Windsor, on the other side, has its highest tax rate, which is about 1.81%

Tax Implications Vary for Different Types of Condos in Canada

Standard Condominiums

Owners pay taxes based on their unit’s assessed value, which considers the unit’s size, the building’s condition, and the sale prices of comparable condominiums. Generally, condos have a lower property tax.

Cooperative Housing

Cooperative housing has different ownership and tax systems than condominiums. Co-ops impose taxes on every single building and split them among inhabitants, which are frequently included in maintenance costs. These taxes are deductible from your earnings as itemized deductions.

How are Cooperative Societies Different than the Condos?

Condominiums are different from cooperative housing, yet there is a common misperception. Cooperative housing has a unique structure in terms of property ownership and taxes.

In co-op housing, you own shares in the business that owns the structure or the entire complex. However, the local taxing body charges taxes on the entire property, including shared areas. The corporation is then responsible for collecting taxes for the shareholders, which is typically charged as a maintenance fee.

Concluding Note

The property tax on condos is based on the square footage and property. As a result, condos have a lower property tax, and the tax on communal areas is shared, which is another benefit. Taxes, particularly in areas like Toronto, are less exorbitant than one might anticipate. However, the other expenses in Toronto certainly make up for it.

Also, the city boasts many working professionals who rent condos. The tax is calculated differently for these, taking non-residential terms into account. If you plan to rent out your condo unit, the money will be taxed as personal income.

There are numerous factors to consider before investing in condominiums. Yes, they are getting increasingly popular, but be sure you are making the correct decision at the right moment.

Learn more about the property tax in your area and how it will affect your finances.

Related Article: Are Condos A Good Investment in Today’s Real Estate World?

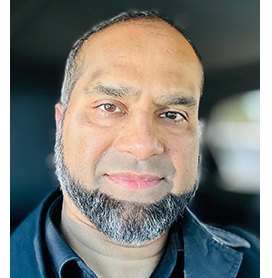

My name is Adnan Khan and I am a realtor specializing in Pre-construction condos and homes sales.

I also do assignments of condos. You can contact me at 416-897-4714

Designation: P.Eng

Education: McMaster University, Engineering Technology

Specialty: Residential Real Estate

Experience: 15+

Area Covered: Downtown Toronto and Neighboring Area

Languages Spoken: English, Urdu

Leave a Reply